Home / Investment / Tax-Free Saving Account

Tax-Free Saving Account

Accelerate Your Wealth

Accumulation

Tax-Free Growth Has

Never Been Easier

Our Established & Reliable Canadian Insurers

Check Out Our Investment Calculator

Savings Calculator

©2025 AccurateCalculators.com

$ : mm/dd/yyyy

Original Size

Currency and Date Conventions

The calculator will remember your choice. You may also change it at any time.

Clicking "Save changes" will cause the calculator to reload. Your edits will be lost.

Cash flow forecast...

Charts

Help

Message

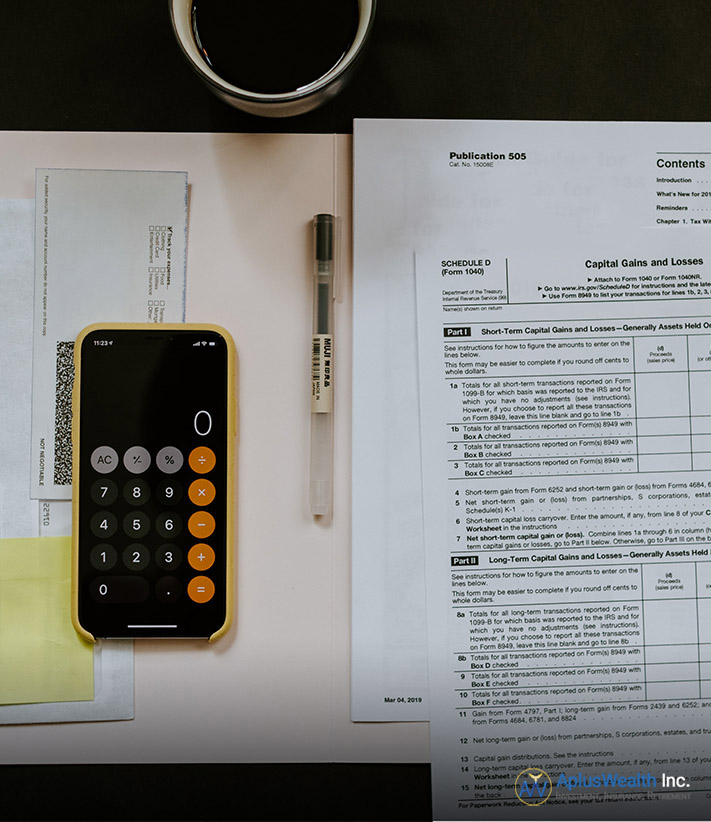

Periodic Saving Amount :

Enter the amount that will be deposited into your saving account each month.

Number of Periods to Save:

Enter how many months you will deposit into your saving account. Example: If you are depositing for 2 years, enter the number 24.

Interest Rate :

Enter the expected rate of return (ROR). This is the ROR that you expect to receive from your portfolio.

- Be a Canadian resident

- If the client is a non-resident, the Company will refuse to issue the TFSA

- Be age 18 or over

- Have a social insurance number

When an individual is no longer a resident:

- His TFSA can continue to exist

- His investment income remains tax-free

- No new TFSA contribution room accumulates during the years of non-residence

- Any contributions made during years of non-residence are subject to taxation of 1% per month. Once the TFSA is issued, the Company no longer verifies residency status.

- Withdrawals made during years of non-residence are not taxable and are added to the unused contribution room the following year. However, this recovered contribution room can only be used when the taxpayer returns to live in Canada.

The TFSA contribution ceiling is the same for everyone, regardless of earned income. This amount is indexed each year at the rate of inflation and the result is rounded off to the nearest $500.

| Year | TFSA Limit |

| 2009 – 2012 | $5,000 |

| 2013 – 2014 | $5,500 |

| 2015 | $10,000 |

| 2016-2018 | $5,500 |

| 2019 | $6,000 |

- Daily interest Account

- Guaranteed Interest Fund

- Segregated Funds

You ask the question, we will find the answer

Call us at 1-888-461-6120 or schedule a call for a later time.